Why You Need Home Insurance With Flood Protection: Explained

Home insurance is an important consideration for any homeowner or renter, and it includes a wide range of coverage.

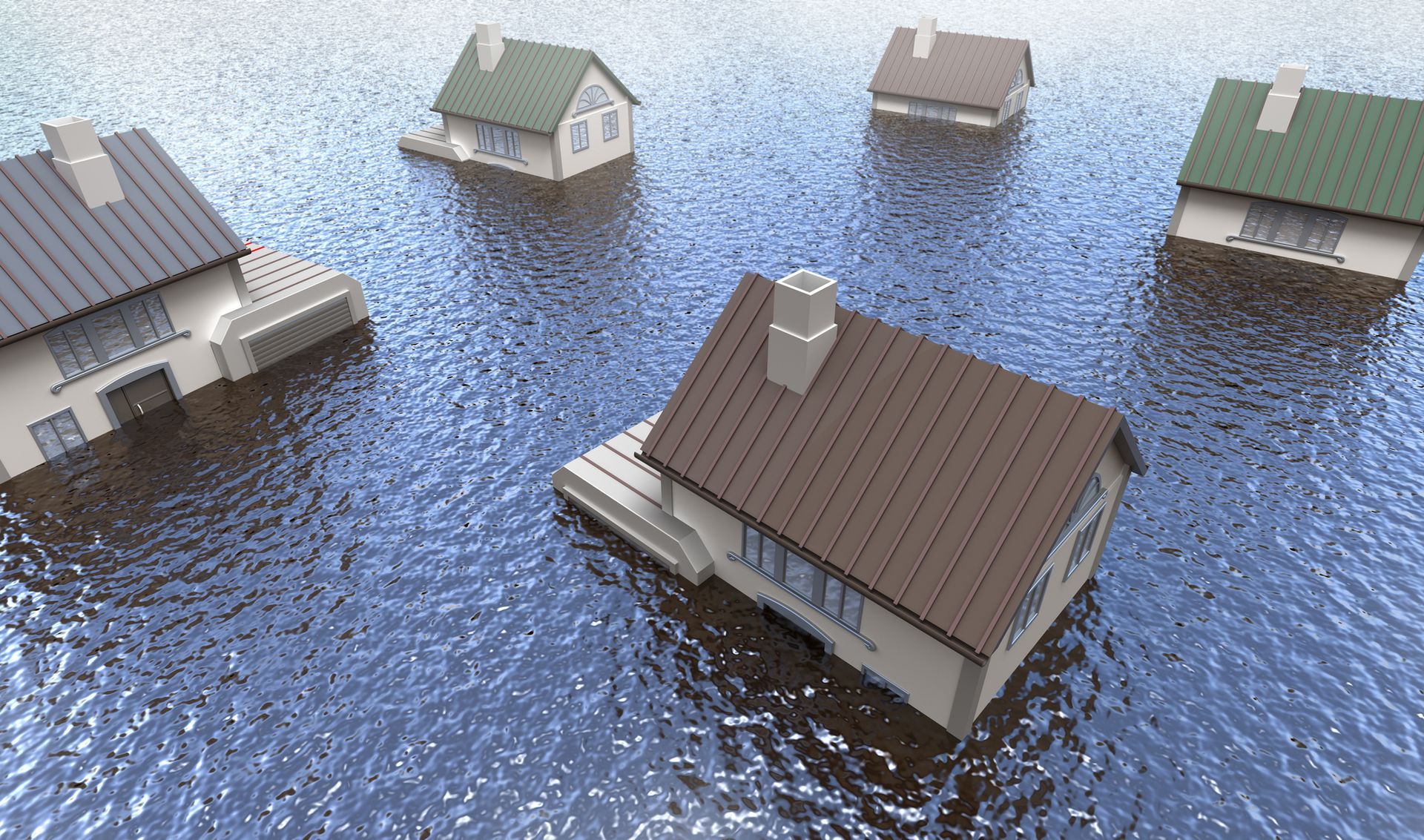

One particular aspect of home insurance that must not be overlooked is flood protection. Floods can cause significant damage to homes and their contents, making this type of insurance essential in many parts of the world.

Homeowners should understand the importance of including flood protection when taking out a home insurance policy. Those living in areas known to experience floods should consider purchasing additional coverage such as excess flooding cover or storm surge cover, which are both available on most policies.

Contact Us

We will get back to you as soon as possible.

Please try again later.

Flooding is often excluded from standard home policies, so it is crucial to ensure your insurer offers adequate levels of coverage before signing up for the policy.

What Is Home Insurance?

Home insurance is an essential part of homeowner responsibility and protection. It helps to protect one's home from potential risks such as fire, theft, or flood damage. In particular, flood protection can be especially beneficial for homeowners in areas prone to flooding or other natural disasters. Imagine a family’s dream house suddenly becoming submerged in water due to events out of their control. – No one should have to experience the nightmare of losing their entire home and possessions due to floods without proper insurance coverage.

Therefore, it is important that homeowners understand the importance of having adequate flood protection included in their home insurance policy. Flood policies typically cover direct physical losses caused by rising bodies of water and general rainfall over land areas resulting in flooding conditions. Generally speaking, they are designed to help replace damaged items lost during a storm and compensate for any repairs needed after the event has passed.

For those living near coastal regions or rivers with high levels of precipitation, investing in reliable

flood insurance can provide peace of mind, knowing that your property is safe from whatever Mother Nature may throw at it. Additionally, many modern insurers offer discounts when bundling multiple types of coverage together or if you choose higher deductibles for certain types of claims; this could potentially save money on premiums while still ensuring sufficient coverage against possible catastrophes like floods.

What Is Flood Insurance?

Home insurance provides essential coverage for homeowners to protect their primary asset. In addition, flood insurance is an important factor in protecting a home from the potential dangers of rising water levels and other forms of water damage caused by flooding.

Flooding can cause extensive property damage due to the high volumes of water that accumulate during heavy rain or snowmelt events, and it is often difficult to predict when floods will occur. Flood safety requires proactive planning on behalf of the homeowner, including purchasing a comprehensive home insurance policy that includes flood protection.

A quality flood insurance policy should cover both direct and indirect losses resulting from flooding, such as structural damage, furniture replacement costs, cleanup expenses, and more. Other key features also include:

- Coverage for detached buildings like garages or sheds;

- Payment for temporary living arrangements if needed;

- Reimbursement for debris removal costs associated with flooding;

- Access to emergency services following a flood event.

Taking these steps ensures homeowners have the financial protection they need in case of any unexpected calamities caused by flooding.

Why is flood insurance important?

Flood insurance is an important consideration for homeowners. It helps to protect against financial loss due to flooding, a natural disaster that can cause tremendous damage and disruption of life. Floods often occur with little warning and can result in significant losses related to water damage, destruction of personal property, and other associated costs.

The following table provides examples of how flood insurance may be used to cover various types of damages:

| Type | Description | Example |

|---|---|---|

| Structural Damage | Damages to the structure or foundation of the house caused by floods | Repairing walls after water has seeped through them |

| Contents Damage | Losses incurred as a result of items being damaged or destroyed by flood waters | Replacing furniture ruined by rising waters |

| Unforeseen Costs | Unexpected expenses incurred while dealing with the aftermath of flooding | Hiring professionals to remediate mold caused by moisture buildup in walls |

Having adequate flood insurance coverage is essential for any homeowner who lives in an area prone to flooding. Without such protection, repairs and replacements necessary after a flood could prove financially crippling. Even if there is no immediate risk of flooding, having this type of coverage provides peace of mind knowing that protecting valuables from potential water damage will not be left solely up to one’s own finances.

What Types of Flood Insurance Coverage Are Available?

When it comes to home insurance with flood protection, there is no one-size-fits-all solution. According to the Insurance Information Institute, only 12% of homeowners have a separate policy for flooding. This means that most people are at risk from floods and should consider buying coverage specific to this type of disaster.

There are several types of flood insurance available, depending on your needs. The two main forms of flood insurance are renter's coverage and excess flood policies. In the event of flood-related property damage, renter's coverage typically offers basic financial support. It may include reimbursement for repairs or replacements as well as compensation for personal items lost during the incident. Excess policies provide additional protection beyond what is provided by standard homeowner’s policies, such as higher limits for covering more expensive items like furniture or electronics that may be destroyed due to flooding.

In order to make an informed decision when purchasing flood insurance coverage, here are five key points to keep in mind:

- Understand the different levels of coverage offered - know what is included and excluded under each policy

- Know if you're eligible - some insurers may not offer certain types of policies in certain areas or circumstances

- Check any exclusions - some policies exclude certain properties or locations from being covered

- Ask about discounts - many companies offer discounts if multiple policies are taken out together

- Compare prices before deciding - shop around to get the best deal possible

Knowing how much coverage you need can help you save time and money when searching for suitable flood insurance options. Researching various providers thoroughly will ensure that you find a policy that meets your individual needs while still providing value for money.

How To Choose The Right Home Insurance Policy With Flood Protection

When choosing a home insurance policy with flood protection, it is important to understand the coverage limits and financial risks associated with floods. Through careful research of your specific area's flooding history, you can determine if purchasing additional coverage for potential damage due to overflow or storm surge is necessary.

- Understand Your Flood Risk: Seattle is prone to floods due to its topography and close proximity to bodies of water. It is essential to determine the flood risk associated with your house before choosing a home insurance policy. You can determine the possibility of flooding in your area by using important information about flood zones that is provided by local authorities and FEMA's Flood Map Service Center.

- Check National Flood Insurance Program (NFIP) Participation: Policies for flood insurance are available from the NFIP as an addition to regular homeowners' insurance. Check to see if the insurance company you have selected is a member of the NFIP. The federal government supports NFIP policies, which offer crucial coverage for losses caused by flooding.

- Evaluate Coverage Limits and Exclusions: Examine the flood protection coverage limits in your house insurance policy with great care. Recognize any applicable restrictions or exclusions. It's important to understand the scope of coverage because certain policies might not cover certain forms of property damage.

- Assess Additional Living Expenses (ALE) Coverage: Your house can become unusable after a flood, in which case you would need to look for temporary housing. Make sure that Additional Living Expenses (ALE) coverage—which helps defray the expense of living elsewhere while your house is being repaired—is included in your home insurance policy.

- Consider Deductibles and Premiums: Examine the premiums and deductibles related to your house insurance policy's flood protection. A fair premium and a deductible that you can afford easily in the case of a claim should be balanced. Certain insurance allow you can modify the deductible to better fit your budget.

- Explore Private Flood Insurance Options: Examine your alternatives for private flood insurance in addition to NFIP plans. A few private insurers may be able to better meet your demands with their reasonable prices and extra coverage alternatives. To make an informed choice, compare pricing and policy information.

In addition, take into account additional costs like deductibles, which could be considerable depending on the severity of any flooding event; these factors should be weighed carefully before committing to any particular plan so that a homeowner has sufficient coverage at times of need without incurring excessive premiums or out-of-pocket expenses during repairs or replacements.

Learn More About Your Home Insurance with Washington Flood Insurance

The importance of having the right level of home insurance with flood protection is essential for those living in areas prone to flooding. It provides financial security and peace of mind, knowing that should a natural disaster occur, there is adequate coverage provided by an insurer.

Selecting an appropriate policy requires research into what types of coverage are available and how much they will cost. The irony lies in the fact that only when faced with such disasters do we realize just how vital home insurance with flood protection can be, providing us with solace at a time when we need it most.

It pays to be prepared; having adequate cover gives you the reassurance that your property and possessions are safe.

Visit Seattle Flood Insurance to help review your current home insurance policy. Ensure that it includes comprehensive flood protection that aligns with the unique challenges of living in Seattle. Don't wait for a disaster to strike—proactive decision-making today can save you from the headaches and heartaches of tomorrow.

Affordable Insurance With Personal Service - Local Agents & Brokers

CONTACT US

Phone: 206-759-2566

Insurance Services

Have Questions or Request A Quote

Contact Us

We will get back to you as soon as possible.

Please try again later.