Washington Earthquake & Flood Insurance Agents

If you're looking for earthquake insurance, we have good news! It's available as a separate endorsement alongside your standard homeowners or renters policy. However, it's important to note that this coverage typically doesn't include damage from floods or tidal waves, even if they're related to the earthquake.

To protect your home and belongings in the event of a flood, many providers offer separate flood insurance policies. At our agency, we have experienced agents and brokers who can help you find the perfect policy at an affordable premium. Give us a call today at 206-759-2566 for a quote and start saving money! We proudly serve Washington, Seattle, Tacoma, and Puget Sound.

We're excited to assist you!

Helping Homeowners & Businesses Protect Their Investments By Finding the Right Earthquake & Flood Insurance Policy

Washington Flood & Quake Insurance Experts

Multi Company Quotes & Comparisons

Competitive Pricing Affordable Plans

Customer-Focused

Business Analysis & Audit

Washington Earthquake & Flood Insurance Services

As your insurance provider and specialist, we ensure that you receive a good quality of services. We provide reliable and professional services to meet all your needs.

Earthquake Insurance

As a homeowner, you can now rest easy knowing that you and your abode are safeguarded against any calamities that may arise from earthquakes, volcanic eruptions, and other natural disasters. Our insurance policy provides coverage for any damages to your home, car, and other structures that may result from earthquakes. In addition, you can be assured that any uncertainty arising from such disasters will be taken care of by our comprehensive earthquake insurance policy.

Flood Insurance

As a homeowner, it's crucial to invest in the right insurance policy to safeguard your investment. Flood insurance is a specialized type of home insurance that covers damages caused by external flooding. It's a cost-effective way to protect your home and belongings from potential water damage. Moreover, flood insurance provides comprehensive coverage for your possessions, which is a valuable addition to your standard home insurance policy.

Homeowner Insurance

Homeowners insurance is a crucial aspect of homeownership that offers security and peace of mind to homeowners. It provides protection against unexpected damages and theft that could potentially occur within your private residence. This type of insurance is commonly referred to as homeowners insurance and is widely utilized across the United States. It is a fundamental component of homeownership as it helps to safeguard one of your most valuable assets, your home.

Earthquake Insurance

Protect your Seattle condo with comprehensive insurance coverage tailored to your needs. Our condo insurance policies safeguard your unit, belongings, and liability, giving you peace of mind in the heart of the Pacific Northwest. Whether you're in downtown Seattle, Capitol Hill, or Queen Anne, we offer competitive rates and personalized service.

Homeowner Insurance

Affordable renters insurance in Seattle, WA, designed to protect your belongings and provide peace of mind. Whether you’re renting in Capitol Hill, Ballard, or Downtown, our policies cover theft, fire, water damage, and liability. Get a fast, hassle-free quote and ensure your possessions are protected in the Emerald City. Secure your home today with reliable renters insurance!

Washington Earthquake & Flood Insurance Services

Earthquakes and floods are one of the most intense and frightening events that could ruin everything in just one wipe. Extreme movement and ground shaking can result in massive destruction to every building and ground. A sudden shake can also trigger an underwater event called a tsunami. These extraordinarily long and giant waves can also be an event of destruction if they reach the shore and land.

Flooding occurs anywhere, along with heavy rain, snow melt, and poor drainage systems. You can minimize the damage of overflowing water by buying a policy covering these two dramatic events. We all know that your standard homeowners' or renters' policies cannot cover these certain losses. To protect yourself and your property, you can purchase a separate earthquake and flood insurance coverage policy. We won't let these two ruin everything from the ground.

Houses and business buildings are generally required to buy a flood policy within a high-risk flood area. Damages or losses due to landslides, settlements, mudflow, or rising and sinking of the earth might cover the damage if proven made from an earthquake.

The rates vary on the location and the risk of an earthquake. The cost of earthquake insurance typically offers a high deductible, which can be beneficial if the entire house when destroyed, unlike if the house is merely damaged. In addition, rates may differ and be cheaper for homes made of wood, which is a greater chance to survive than houses made of stone/brick.

Understanding Earthquake & Flood Insurance—Who Should Get A Coverage

Earthquake and flood policy is different from each other as well as provide additional coverage. However, both of them protect certain events. Your earthquake policy can cover your home coverage, living expenses, personal expenses, and sometimes more, depending on the type of policy you get. At the same time, flood insurance can help cover the devastating damage to your home's structure and content.

There are several reasons why it is a must-have coverage. For starters, it will cover the costs of damages and rebuilding your property after an earthquake. Increasing your deductibles helps you lower your monthly premiums. Additionally, you can save money by getting a policy in an area less prone to earthquakes because it is a good idea to get a quote before buying an earthquake policy.

To give you more ideas about the policy, you can consult an expert to help you assess your area's risk.

Moreover, you should consider purchasing an earthquake insurance policy if you live in an area where fracking is prevalent. California, Texas, and Oklahoma are known for having high earthquake risks. Before getting coverage, remember that the policy should cover the entire rebuilding costs of your home, not just the market value. Make sure to understand the complete form of coverage since it constitutes the cost of construction materials such as labor.

Another important consideration when getting coverage is whether you need flood protection. As we mentioned, constant ground shaking might result in a tsunami which can lead to a flood. In addition to paying for replacement materials for your home, earthquake insurance can also pay for additional living expenses.

Flood Insurance Experts

Flood Insurance Experts

Is Flood Insurance Policy Required

If you are planning to buy a flood insurance policy, you should assess if your house land in a flood-prone area. Many communities can qualify for a policy through FEMA. However, if you live in an area where flood maps change frequently, you may not be able to find one without getting a quote. Vice versa, if you live in a high-risk area, you can purchase a separate policy from a private company.

A typical flood insurance policy will pay for the replacement costs of your home after a flooding event. It does not cover losses that happen before the flood. Moreover, you cannot increase the amount of coverage once the flood starts. In some areas, flood insurance is necessary, but there are also some exceptions. Generally, a flood insurance policy costs about $260 annually for a $100,000-per-inclusion limit. While this is a good start, you must ask if you need a policy.

Some areas are required to have an insurance policy by the federal government. In many cases, the insurance coverage is less than what you need, but the amount is still significant. And a flood insurance policy will provide you with peace of mind.

Is Flood Insurance Policy Required

The USA consists of 50 states, and 16 face the world's highest seismic risks. Although the country divides into four major earthquake zones, all 50 states will likely experience damaging ground shaking within the next 50 years.

California, the Pacific Northwest, and the Intermountain West are most at risk of shaking. The New Madrid Seismic Zone runs through the center of the country, near cities such as Charleston, South Carolina.

The U.S. Geological Survey has updated its maps several times, indicating that the western U.S. is at a higher risk of earthquakes. Insurance companies and influence heavily rely on the maps, worth billions of dollars in construction each year.

In addition, by updating the United States' earthquake maps. There are new data from the USGS and UCERF3, which helps us better understand how much seismic risk each area faces. These new updates give ideas about the shakes, fire-following, and liquefaction components, as well as tsunami and landslide sub-peril.

This information and the new model can help us better protect our communities from earthquakes.

Washington State, Earthquake & Flood Insurance Trusted Provider

Do you have any questions/concerns?

We work with multiple carriers for your convenience.

Comprehensive Flood & Earthquake Protection for Your Family's Peace of Mind

Washington & Seattle's Top Earthquake & Flood Insurance Specialists

News & Blogs

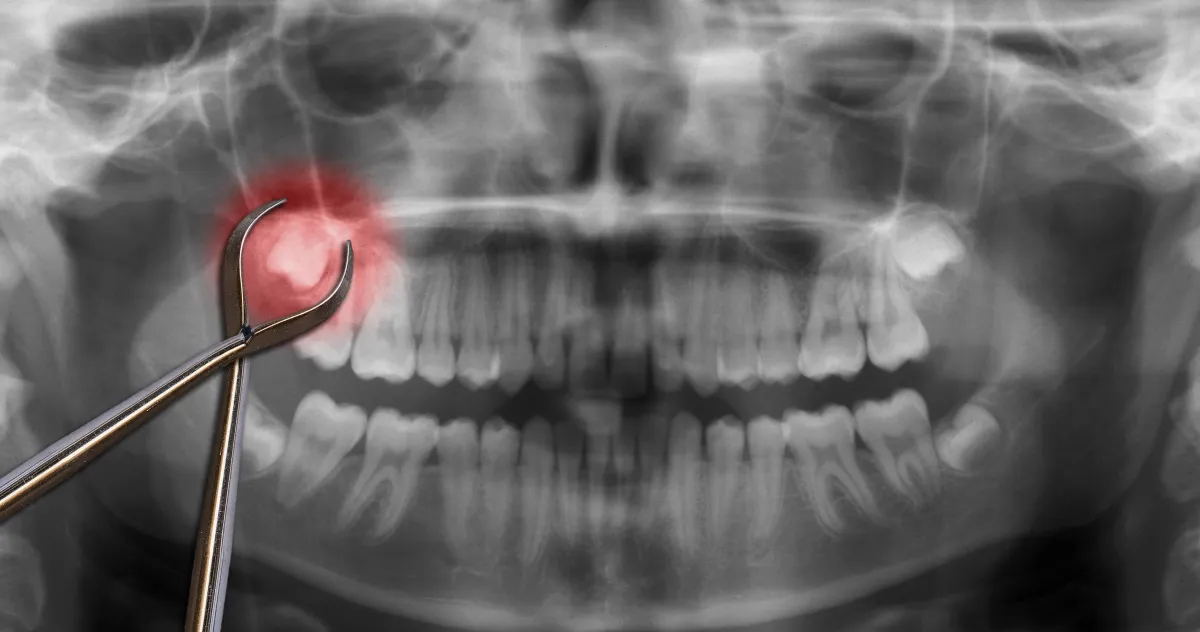

Emergency Dentist East Plano | Same-Day Emergency Dental Care

East Plano emergencies often come with real-life constraints: family schedules, school pickups, work commitments, and the hope that maybe the pain will “just calm down.” The problem is that dental emergencies don’t run on hope. Pain escalates. Swelling can appear. A cracked tooth can worsen. And the best time to address it is usually earlier than you think.

If you’re searching for an emergency dentist in East Plano, you want a same-day plan, clear answers, and a team that takes urgency seriously—without turning everything into a confusing sales pitch.

Call Now for Same-Day Emergency Dental Care

People Also Ask: Is gum swelling a dental emergency?

It can be. Swelling may signal infection and should be evaluated quickly—especially if it’s spreading, painful, or paired with fever.

Common East Plano emergencies

Severe toothaches that keep you awake

Broken teeth or cracked fillings

Crowns/fillings falling out

Swollen gums/facial swelling

Abscess symptoms (drainage/bad taste)

Trauma from accidents or sports

Even if you’re not sure, call. Triage is fast.

People Also Ask: Can I get seen the same day in East Plano?

Often yes—especially for pain, swelling, broken teeth, and lost crowns. Call early for the best availability.

What an emergency visit looks like

Emergency visits focus on solving the immediate problem:

Exam + symptom review

X-rays if needed

Stabilization: stop pain and protect the tooth

Same-day treatment when appropriate or a fast plan forward

Emergency dentistry is about preventing escalation. That’s what saves teeth and reduces total cost.

Insurance, cash pay, payment plans

We support:

Most major dental insurance

Cash pay

Payment plan options (where available)

No insurance? Still call. Delaying often increases cost.

Weekends, holidays, and 24/7 phone support

Link internally and mention clearly:

What to do right now

Avoid chewing on painful side

Salt water rinse (gentle)

Cold compress for swelling

OTC meds as directed

Save crowns/broken pieces